KommuneKredit announces Responsibility Report 2018

KommuneKredit has today, 1 March 2019, published its Responsibility Report for 2018.

KommuneKredit has today, 1 March 2019, published its Responsibility Report for 2018.

The Board of Directors of KommuneKredit have today, 1 March 2019, approved the Annual Report for 2018.

Today, KommuneKredit issued its second benchmark in DKK. This time a new long 3-year bond, maturing on 19 May 2022 and carrying a 0% coupon. The finale size of the bond offering was DKK 5bn and the bond issues was arranged by joint lead managers Danske Bank and Nordea.

On 31 October 2018 KommuneKredit launched a DKK benchmark. The bond issue was DKK 3 bn. with 5 year maturity. Nordea Bank and Danske Bank were joint lead managers on the issue.

Moody’s Investor Service has published their Update to Credit Opinion confirming KommuneKredit’s Aaa rating and stable outlook.

Moody’s highlights KommuneKredit’s:

close link to government and the joint and several liability provided by all Danish regional and local governments

the excellent asset quality

direct oversight by sovereign, with prudent counterparty risk policies

a s

The Board of Directors of KommuneKredit have today approved the Interim Report for 2018.

CEO Jens Lundager states: “KommuneKredit does not need to make a profit on our lending to municipalities and regions. Thus, our profitability is expressed through low interest rates rather than high earnings. We have had a satisfactory development in the first half of 2018. Required earnings has been below

On 22 August 2018 KommuneKredit launched a new benchmark issue – a EUR 500 million 5-year issue.

The issue was successful with strong investor interest and a few hours after launch orders totalled more than EUR 1 billion. The strong demand from investors created room for a price adjustment to the final pricing at mid-swaps minus 12 bps. More than 45 investors participated.

The bond issue is

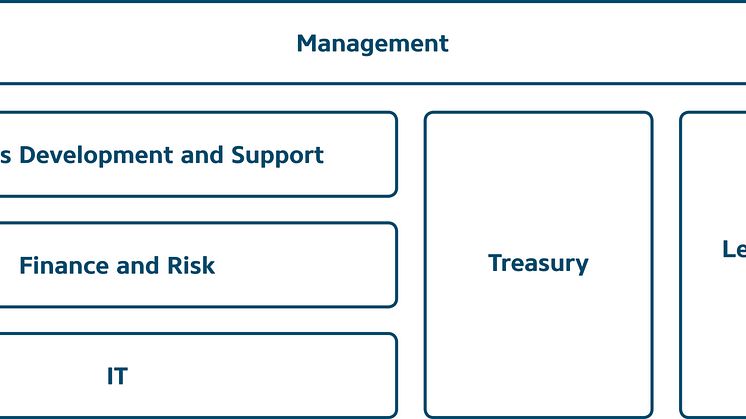

On 1 September 2018 KommuneKredit will be implementing an organisational change, which will underpin our Strategy 2022.

We are consolidating our client-based activities in one new department, Lending and Leasing, with Director Christian Jeppesen as new Head of Department.

Director Jette Moldrup is the new Head of Department for the Treasury department. Eske Hansen continues in the Treasury d

Earlier today, rating agency Standard & Poor’s lowered its long-term issuer credit rating on KommuneKredit from AAA to AA+ (with stable outlook), while affirming its short-term credit rating at the highest level, A-1+.

Standard & Poor’s announced on 22 May 2018 that it had placed KommuneKredit “Under Criteria Observation” due to a change in the agency’s criteria for public-sector financ

Today KommuneKredit issued a EUR 750 million green bond with a 10-year term to maturity. KommuneKredit’s green bonds finance more than 200 local green projects across Denmark. The eligibility of the projects as a basis for KommuneKredit’s green bonds is assessed by a Green Committee. There are green projects from Frederikshavn to Rødby and from Esbjerg to Bornholm, and they include, among other th

On 4 June 2018 KommuneKredit announced a new fixed rate USD benchmark maturing on 15 November 2021. In addition, KommuneKredit offered to buy back two existing bonds with maturities on 27 August 2018 and 15 January 2019 respectively. The 4 banks, Toronto Dominion, Deutsche Bank, Scotiabank and Bank of Amerika Merrill Lynch, were mandated as joint lead managers on the new bond deal as well as the b

The Board of Directors for KommuneKredit has elected its officers for the period 1 June 2018 to 31 May 2022. The elected officers are:

Mayor Lars Krarup, Municipality of Herning, Chairman

Mayor Thomas Lykke Pedersen, Municipality of Fredensborg, Vice-chairman

Mayor Hans Toft, Municipality of Gentofte

Mayor Erik Nielsen, Municipality of Rødovre

Mayor Mikael Klitgaard, Municipality of